Mortgage Sales Simulator

With hundreds of steps in a standard customer application process, making mortgage sales training engaging is a tough ask. We developed a bespoke mortgage simulator that led to dramatic improvements in staff engagement over 600 branches, while helping to safeguard compliance.

Breaking the mould for mortgage training

Mortgages are the bread and butter of most banks and building societies, but there’s nothing simple about these complex loan agreements.

TSB usually schedules a three-hour appointment for customers who are applying for a mortgage; a mortgage advisor needs to complete a staggering 300 steps for a mortgage application, and that’s only for a “straightforward” one!

Comprehensive mortgage training for staff is essential to ensure that the process is followed to the letter, and that each application ticks all the necessary legislation and compliance boxes.

The challenge

Their existing system wasn’t up-to-date with the latest changes in regulations and compliance. It was as dull as a wet weekend in Whitby and trainees hated using it. The bank approached Day One to see if we could do any better.

The Can Do

We developed a two-part solution:

- An e-learning programme that broke down the application process into bite-sized sections. Trainees would complete the programme at their own branches.

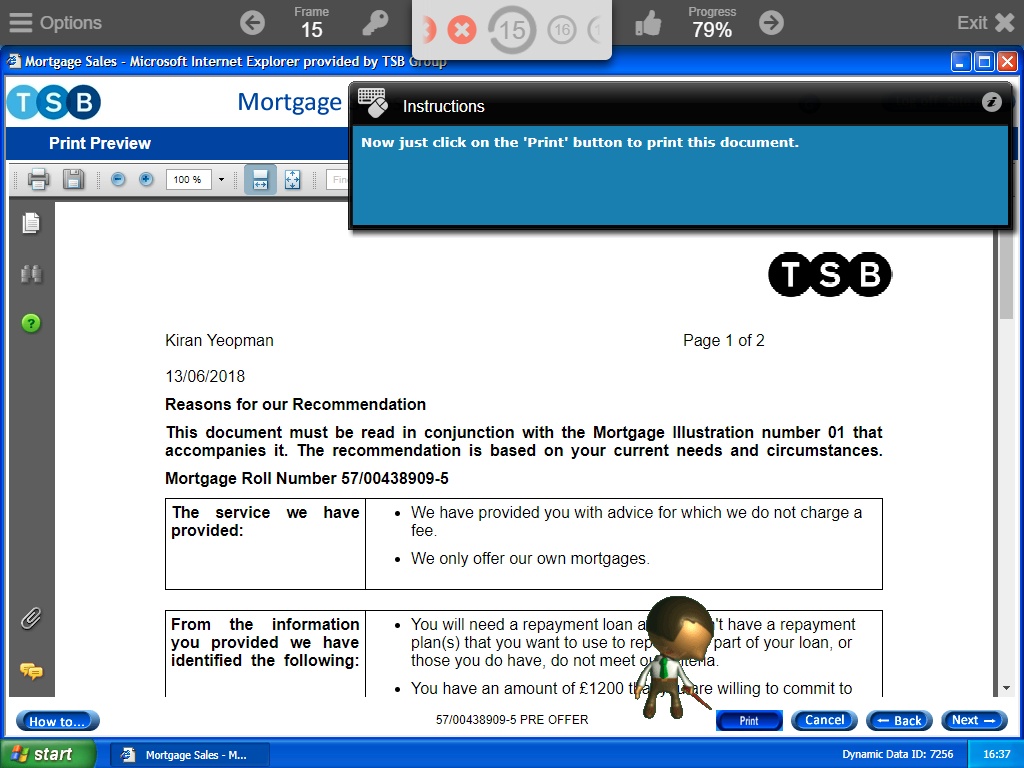

- A mortgage application simulator. After completing the e-learning, trainees would apply their understanding during a mock application process with a partner or assessor playing the role of the customer.

The customer’s paper documents are an important element of mortgage applications, so we made it easy for the trainees to print these out at key points in the process.

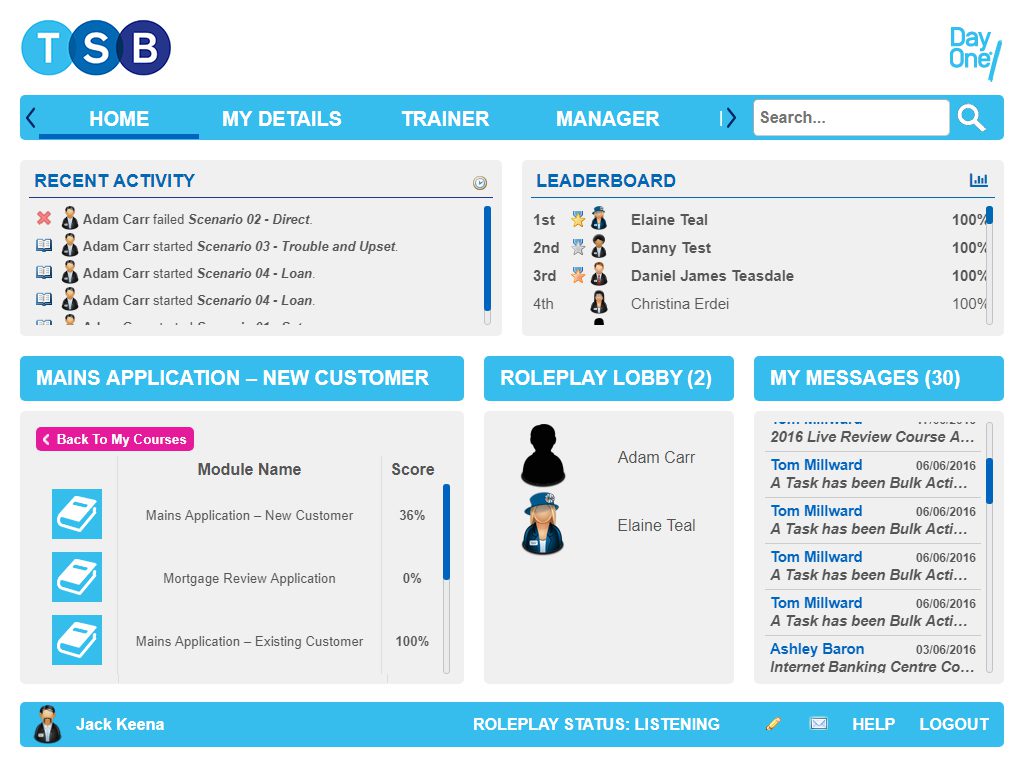

The simulation scores trainees’ actions and allowed assessors to add their observation scores, so it’s easy for the trainers to see at a glance how their learners are doing.

The outcome

TSB was so happy with the new system that they rolled it out to all 600 of their branches in 2016. It’s now an essential part of their blended training, helping to make life a doddle when it comes to teaching and upskilling their staff.

The client verdict

“At TSB, it’s important that we all do business in the right way and part of that means meeting our responsibilities under UK Financial Services regulations – Our Day One training system for Mortgage Applications helps us do just that. Compared to the old training system, our new solution is like the difference between Night and Day.”

DONNA LAIRD

Head of Learning & Development / TSB

Help with system simulations or elearning for finance? Can Do

Whatever your training requirements, the Day One team can deliver on them with a bespoke solution.

Want to learn more? Contact us for an informal discussion about your needs.