Financial Services eLearning

Day One develop financial services elearning solutions for compliance, employee development, software onboarding and more.

We’ve created interactive finance elearning for top global banks, insurance providers and tax / accounting companies.

Finance training at speed & scale

As one of the world’s most highly-regulated industries, finance training is continuous, usually complex, and often required at speed.

eLearning is ideal for financial services training because it is quick and cost-effective to create, update and rollout at scale to a disparate and time-pressured workforce.

Our finance elearning solutions:

- Bespoke elearning solutions with engaging, multimedia content to enhance your L&D programmes

- Scenario based training using ‘eRoleplay’ – peer-to-peer, social learning

- Modular LMS with functionalities and access levels tailored to each user group

- Desktop system simulations, creating true-to-life learning environments for branch, office or call centre staff

- Mobile learning – our finance elearning solutions can be accessible from any device, enabling anytime, anywhere learning.

Bespoke learning content

Helping banks, insurance providers & other finance organisations with interactive, bespoke learning content to transform:

- Inductions & Onboarding

- Finance Product Knowledge Training

- Telephone Banking and Customer Service

- IT System Rollouts

- Data Protection & Records Management

- and much more.

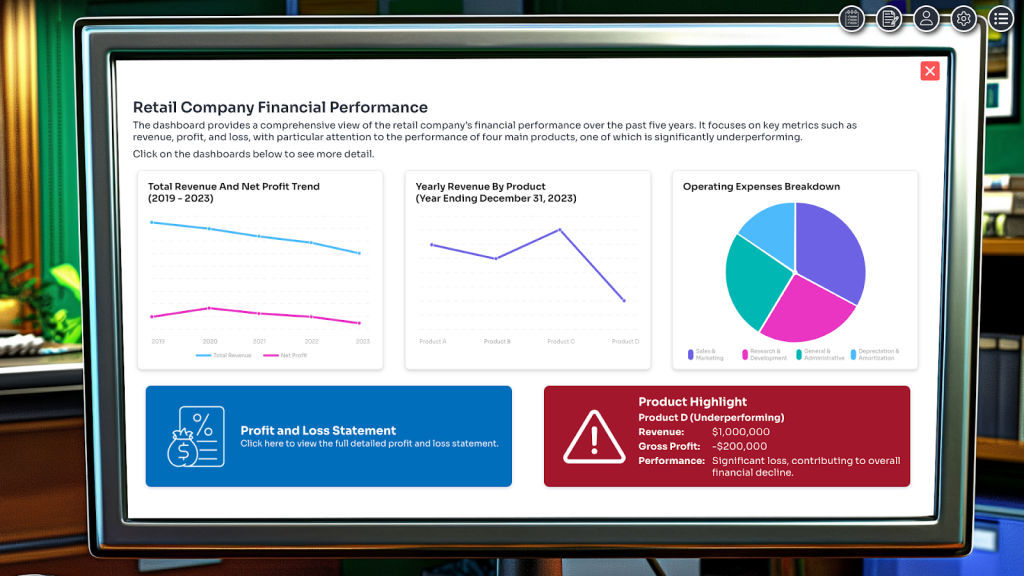

System Simulations

Here at Day One, we’re highly experienced in the working environments of finance companies, including those of their front line customer service and call centre teams.

We have created elearning content, scenario based training, and system simulations for staff that need to manage multiple systems at the same time – situations that are virtually unique to the finance industry.

On-time, on-spec, on-budget

We’ve created highly effective elearning solutions that have been rolled out to thousands of staff simultaneously across hundreds of branches, offices and call centres.

Our focus is always on delivering projects on-time, on-spec and on-budget and we’ve made life easier for our clients in highly time-pressured, commercially-sensitive environments.

Want to make Learning By Doing part of your L&D toolkit?

Financial services training examples

Some of the best examples of our work creating dynamic, bespoke elearning for financial services companies:

Need help with engaging, interactive finance training?

We’re always happy to discuss elearning projects – why not contact us for a no-obligations discussion of your requirements?

Related posts from our blog:

How top financial services companies use elearning & simulations

Large financial services companies are already at the forefront of technology adoption, so many are leveraging elearning and system simulations well to gain a competitive edge.

Why elearning is best for financial services training

The banking and finance sector is rightly one of the most highly regulated, which makes thorough, up-to-date staff training essential to ensure compliance. And the penalties that can result from non-compliance with industry or legal guidelines can be crushing.