In looking at how to create effective banking and finance training with simulation based elearning, we’ll take Mortgages as a good example. These are complicated products to deal with when it comes to training.

The procedures are many and lengthy. Banking and finance processes will often need to deal with verification and credit checking systems & procedures, such as Equifax. There is also all the regulatory red tape – much of which has come around in the post-crash years.

A mortgage simulator to help train out the processes is a very useful thing, but it is certainly challenging to build correctly. There will be a lot of subject-matter experts (SMEs) & stakeholders with differing views on best practice, together with the fact that the client’s IT team will often make system changes without telling any of the stakeholders (or you).

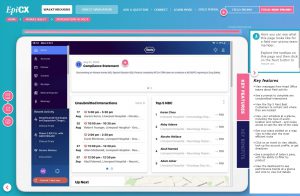

In one banking training project, we built a set of mortgage simulations for TSB, dealing with common customer requests such as:

- Brand new mortgages

- Mortgage reviews

- Buy-to-let mortgages

- Mortgage advances

Here are five tips for this sort of banking and finance training:

- Be very clear about what are the key learning objectives that need to be covered in the simulations. Make sure all the stakeholders and SMEs contribute and OK a list of simulations which will cover all their requirements.

- OK – the above point is pretty rote. But be prepared for the brief to change. A lot. The complexity of the training requirements, for this sort of rapidly changing product, will lead to (at least) some considerable fog.

When people start using the prototype, and this stimulates interest in the business, hitherto unknown senior stakeholders will appear and will want all sort of changes for very reasonable reasons. You don’t want to get into debilitating expectations management and client disappointment, so anticipate this with super-fast prototyping, have flexibility in your build, and if possible keep resources at the ready.

- Make sure there is a lot of flexibility to navigate easily within the simulations. They can be long 100+ step procedures and being able to jump to key points within them is often essential.

- You need to find a way to keep related data (such as dates) current and relevant – otherwise this will lead to confusion.

- Make it as realistic as possible – it really gives confidence to trainers & managers and challenges the trainees more. Little touches (such as simulated printing) can really be appreciated.

I hope you find these tips useful for your next big project!

Need help with elearning or system simulations to improve learning and development for banking and finance? Contact us for an informal chat about your training requirements.