The financial services industry is one of the most competitive – and one of the most highly regulated. This means that L&D and HR departments must maximise their training budgets, while ensuring thorough compliance systems and processes that are always up to date.

Large finance companies are already at the forefront of technology adoption, so many are leveraging elearning and system simulations to speed onboarding and skills development, deliver timely compliance training, and improve product knowledge and customer service.

Here’s how top financial services companies use elearning and system simulations to maximum effect, in order to gain a competitive edge.

Staff Onboarding

It’s common knowledge now that moving at least some of your training into elearning can bring cost saving benefits by reducing time and travel required from in-person trainers, booking facilities etc. There can also be a lot of logistics involved in getting multiple learners together in the same place at the same time, which becomes more inefficient if you have just one or two new starters joining the team.

Training in the form of elearning can be available any time, anywhere at the point of need. During the onboarding process, different learners have differing needs in the form of existing knowledge gaps or sticking points in comprehending new information and procedures.

Revisiting key learning points may be impractical in a traditional, classroom training environment, but if a learner has access to the content via a learning management system (LMS) then he or she can revisit those points at will, while potentially being able to delve into further supporting materials relating to that topic if needed.

Learners may or may not be fully aware of their own strengths and weaknesses, so assessments and analytics within the LMS can also help flag these areas to both learner and administrator, enabling additional support either through signposting within the platform or via trainer support.

This ability to offer a greater a greater level of personalised learning during the onboarding process means that new recruits are more likely to hit the ground running in the live working environment.

In financial services roles that are client-facing and / or that require good knowledge of products and the regulatory framework, these enhanced onboarding capabilities can be reassuring for both Customer Service and Compliance managers, as well as the new employee.

A well-designed and welcoming elearning platform designed in line with the employer’s branding also helps to immerse the recruit in company culture and can be an important point of employee engagement at this early stage when staff attrition is so high.

Skills Development

Many jobs require a high level of product knowledge to perform to a high standard. What can make many financial services roles – especially those that are customer facing in person or through call centres – is the fact that they often have to navigate multiple desktop systems while simultaneously talking with the customers and drawing on that product knowledge.

In a finance call centre environment, the agent may need 7 or 8 systems open at the same time during the sales process or in dealing with a customer query.

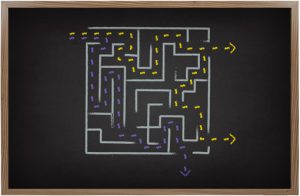

Such multitasking is an advanced skill that is hard to both teach and test for. With system simulation training, a learner can practise these technical skills in a true to life desktop environment, while running through customer scenarios with peers, managers or specialist trainers.

Such practice can greatly reduce time to competence and instil confidence in new starters ahead of their first day let loose on the public.

Change Management

eLearning and simulations can also be of great use during times of rapid change. When Lloyds Bank acquired HBOS, we were drafted in to prepare over 8,000 banking call centre staff in the use of a new, unified IT system with a bespoke, simulation-based training solution. With 25 million banking customers to support, a breakdown in customer service when the new systems went live could have been a PR disaster with costly business consequences.

The simulations helped to deliver as a key part of the Lloyds blended learning programme though, and customer support after go-live was seamless. As industry commentator Jonathan Charley put it in It’s a Financial World:

“Training all the [Lloyds Banking Group] staff to use these systems and new processes – and to do it without interrupting service to customers – represents an enormous success.”

Sales & Customer Service

Having an easy to use LMS can be a great way to keep the latest product knowledge to hand for sales teams. It can also be an excellent repository for adding additional content to aid knowledge sharing and tips from your best performers, reaching others across the organisation.

Large financial services companies may be divided into distinct departments with specialist sales teams or even generate new business via external financial product sales partners. In these cases, a good LMS will enable portals that are structured, and even branded, to the needs of each group. This relevance will enhance engagement and often greatly increase adoption of the system as part of the working environment.

Making sure that sales and customer service staff have the knowledge needed to support customers quickly and effectively is essential to prevent losing them to competitors.

Almost half of consumers report having moved to a competitor because of poor customer service and not being able to get queries dealt with quickly and effectively. As winning new business is one of the highest costs for many companies, it makes sense to reduce this burden by investing in the relatively cheap and easy to implement resource of on-demand elearning to help improve product knowledge for sales and customer service.

Compliance Scrutiny in Finance

In a business environment that is as highly regulated as finance, and one that has been under such media scrutiny for over a decade, good compliance training is an absolute must for any large financial services company.

High profile mistakes in banking and finance are simply not tolerated, while regulations in the UK can be particularly complex.

In 2012, a senior HSBC boss saw fit to resign following a well-publicised failure to prevent money laundering, and the bank was hit with a £640m fine.

In 2018, TSB’s Chief Executive, Paul Pester, left his role by “mutual agreement” after the bank’s widespread IT failure, which shows that the public, government and shareholders demand excellence at all levels within a large financial services organisation.

In 2022, Nikolay Storonsky, co-founder and CEO of London-based challenger bank Revolut commented on what he perceived as ambiguous “grey zones” in UK regulation, and that tensions between regulators and Revolut’s compliance teams had been causing problems at the company.

Speaking at the 2022 CityUK summit, Storonsky said:

“We applied for 48 licences across the globe, and we received 44, and three of the licences that we haven’t received are actually in the UK”.

eLearning for Faster Training

As new legislation comes in, and as the fast-moving Fintech environment forces companies to constantly reassess their processes and infrastructure, elearning is sometimes the only viable way to ensure training is implemented fast enough.

When new training is required to ensure knowledge is up to date in areas such as Anti-Bribery, Corruption or Money-Laundering, proactive companies will have push notifications to guide learners to the latest content, track use of the the materials, and where appropriate, report on successful completion / examination.

When training needs change quickly, elearning is naturally an efficient way to use and roll out updates. For large companies with the in-house resources to do so, it pays to have your teams able to update materials when necessary, rather than outsource maintenance of every detail within the content, and every aspect of managing that content within the LMS.

To maximise the business benefits of elearning, top financial services companies will update and roll out content at the speed of need, rather than being reliant on the timescales of their external developers.

A good elearning company will give their client the tools needed to keep their content fresh and relevant.

Employee Retention

The cost of replacing an existing employee is upwards of £6,000 for junior level roles and tends to rise in line with the seniority of the position, and this is the case worldwide. The Work Institute in the US for example, recently put the figure at 33% of that worker’s annual salary. Replacing a middle manager within a finance company could easily run upwards of £25k.

Lack of training and development opportunities is consistently cited as one of the most common reasons for employees to leave a company. Therefore, making learning materials available and well-signposted can make your best people not only able to actively seek a way to improve their performance within your company, but feel more valued and engaged as well. Win-win.

Can We Help You?

If you’re interested in how we help leading companies in the UK and Europe with Finance eLearning solutions, do browse our site or contact us for a no-nonsense, no-obligations chat about our services and your needs.